We’re back with another funding review, and this one will cover everything from September 2021 to March 2022. UCSB startups were busy during this period, raising no less than $77 million in venture funding and completing a $1.55 billion IPO.

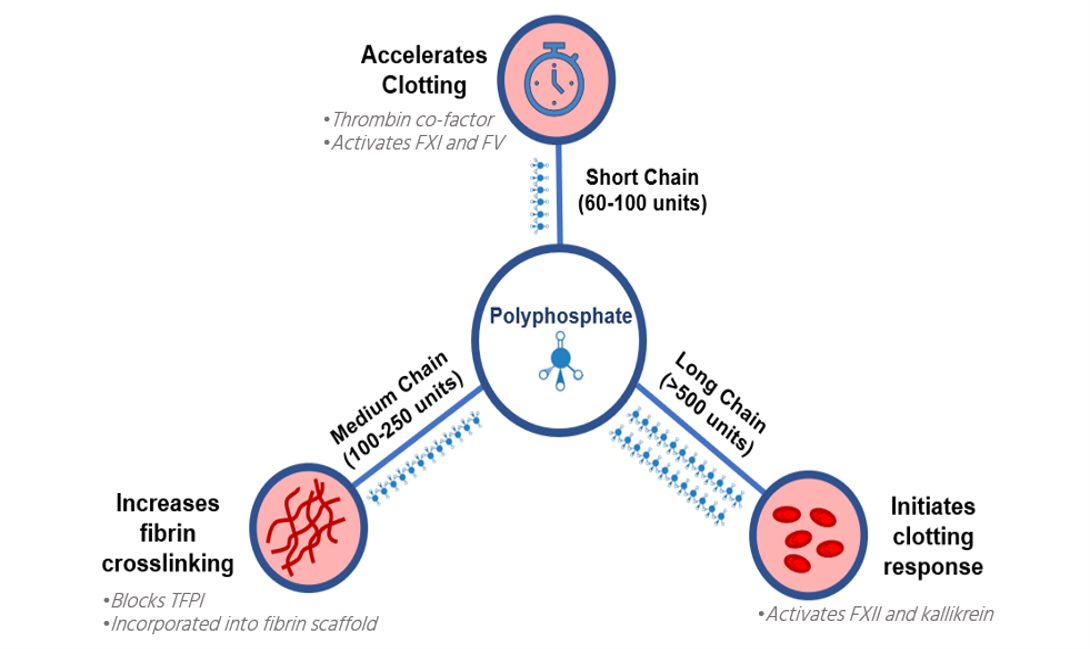

Polyphosphates are key to Cayuga's technology, and their activity is dictated by the chain length of the molecule. This image demonstrates the versatility of the technology to achieve various results. Image, Cayuga Biotech |

Cayuga Biotech – Undisclosed AmountCayuga Biotech is harnessing biomimetic polyphosphates to address severe bleeding and wound healing, a critical topic in the fight against staggering mortality rates due to hemorrhage. Cayuga won the 2020 UC Startup Pitch Showcase and gathered more momentum as a participant in the Indie Bio accelerator program. They also recently installed experienced biotech executive, Andrea Ashford-Hicks, as their new CEO. Co-Founder and Chief Science Officer Damien Kudela earned his Ph.D. in Materials Chemistry at UCSB and his research became the foundation of the company. Cayuga raised seed funding from SOSV this January, bringing their total funding to $250K. |

|

Putting windows like these to work harvesting solar energy in commercial buildings could be a major energy saver. |

NEXT Energy Technologies - $1 millionNEXT Energy Technologies develops window technology that harvests solar energy on commercial buildings. Just based on that short description, you may be thinking that this company is pretty busy these days — and you would be right. Co-Founder, President, Chief Technology Officer, and Board Member Corey Hoven earned his Ph.D. in Materials at UCSB in addition to a Management Practice Certificate from TM. The company raised $1 million of later-stage venture funding from Regatta Capital Group and other undisclosed investors on January 3. |

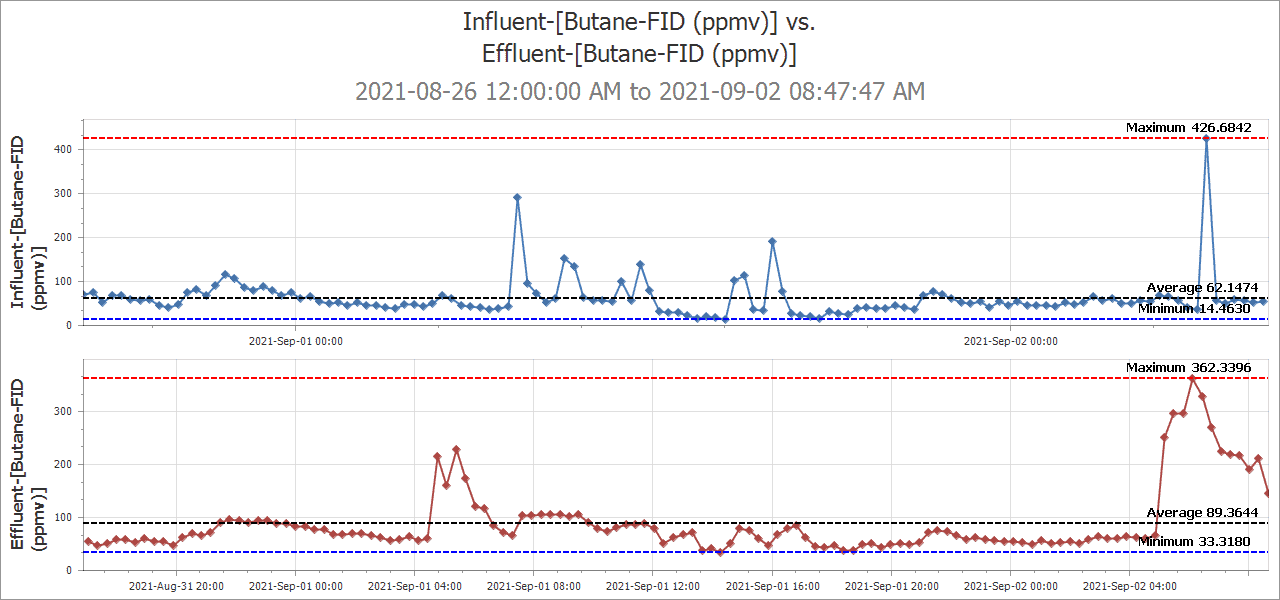

Butane readings at a cannabis facility collected by VaporSafe®, a Groundswell subsidiary. This data in particular displays crucial safety information for the facility. Image, VaporSafe® |

Groundswell Technologies - $1.74 millionGroundswell Technologies was founded by Mark Kram in 2004 to create a more holistic approach to earth monitoring software. Kram studied at UCSB as an undergraduate (B.S. in Chemistry) and earned his Ph.D. in Environmental Science and Management (Hydrogeochemistry) from Bren. Additionally, the foundational technology for Groundswell was developed on campus, so this startup is as Gaucho as it gets! This January, the company raised $1.74 million of later-stage venture funding from undisclosed investors. |

Successful carbon sequestration involves stabilizing carbon in a dissolved or solid form from gaseous carbon dioxide. The latter form is especially easy to permanently sequester. |

C-Zero - $34 millionIt’s easy to root for a Gaucho company like C-Zero that is on a mission to build a more sustainable future. Their technology addresses the challenging ecological impasse of natural gas usage. Natural gas is an inexpensive and abundant energy source, but using it comes at the cost of high carbon dioxide emissions. C-Zero’s solution converts natural gas into hydrogen and solid carbon so that the hydrogen can be used as clean, low-cost energy and the solid carbon can be permanently sequestered. The company raised $34 million of venture funding from SK Gas and other undisclosed investors in December. They also raised an undisclosed amount of venture funding from ENGIE New Ventures in November. Take a look at some of the other exciting news C-Zero has to share! |

High-performance gaming equipment supplier CORSAIR uses Transphorm's technology in their AX1600i power supply, allowing the device to achieve improved size and power output benchmarks. Image, CORSAIR |

Transphorm - $35.9 MillionThe gallium nitride pioneers at Transphorm had two fundraising events during this review period receiving $23 million of development capital from Kohlberg Kravis Roberts and other institutional investors in November and $12.9 million of development capital from MCM Partners and Boardman Bay Capital Management in early December. That makes for nearly $36 million raised by Transphorm in Fall 2021, the highest amount raised on this list… unless you count IPOs (See Olaplex below). |

Olaplex celebrating their initial public offering. Image, NASDAQ |

Olaplex - $1.55 billionAs of September 2021, you can buy your very own shares of Olaplex, one of UCSB’s most exciting lab-to-product success stories. The technology was developed by UCSB professor Craig Hawker and student Eric Pressly, and its initial application was to prevent bleaching and coloring agents from breaking disulfide bonds in hair. The resulting products are now available in over 60 countries and generate hundreds of millions of dollars in annual revenue, some of which comes from high-profile celebrities. The IPO raised $1.55 billion on the NASDAQ stock exchange under the ticker symbol of OLPX last October. |